what is tax planning and tax evasion

Tax Evasion is an unlawful way of. Income- Rs 100- Case 1.

Tax Planning Tax Avoidance Tax Evasion Pdf Tax Avoidance Tax Evasion

Keep in mind that theres a difference between tax planning and tax evasion.

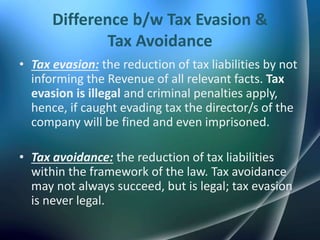

. Iii Tax Avoidance is done through not malafied intention but complying the provision of law. Statutory provisions are followed under tax planning while statutory provisions are violated under tax evasion. In Tax Planning a taxpayer is doing what the govt wants him to do whereas in tax avoidance a taxpayer is doing something which the govt didnt expect the taxpayer to do.

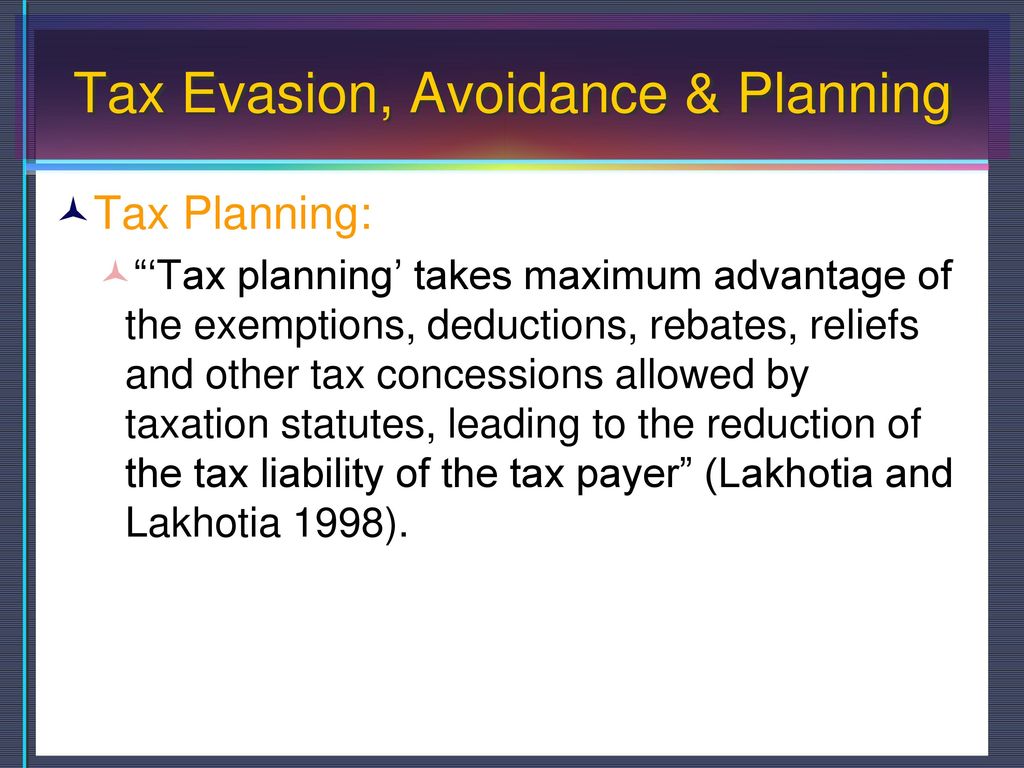

Lets understand it by example. Unlike tax avoidance tax evasion has criminal consequences and the individual may face prosecution in criminal court. In contrast Tax Planning takes maximum advantages of the exemptions deductions rebates reliefs and other tax concessions allowed by taxation statutes leading to.

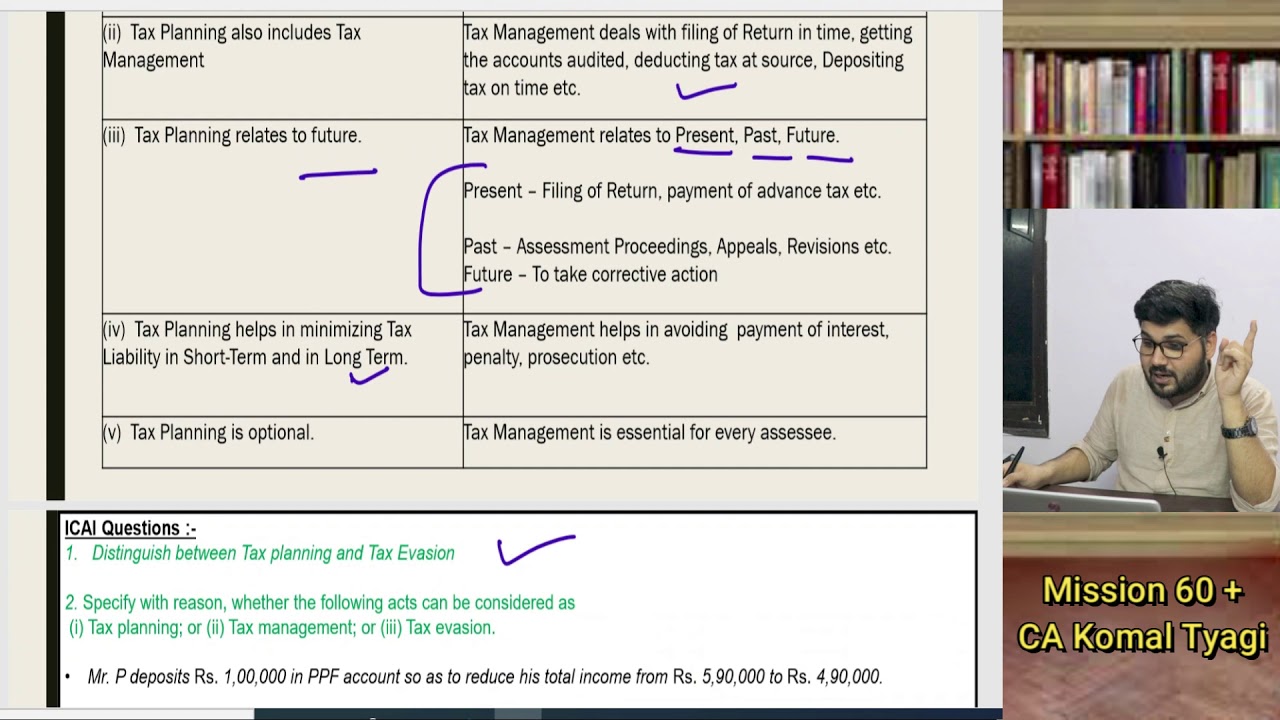

The consequences of tax evasion. Very Simple analysis of different terms under Income Tax Act 1961 Tax Planning Tax Evasion Tax Avoidance Tax Management is as under-. Tax evasion on the other hand is using illegal means to avoid paying taxes.

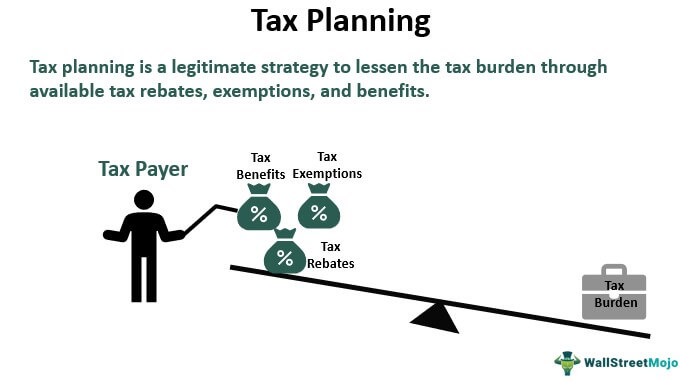

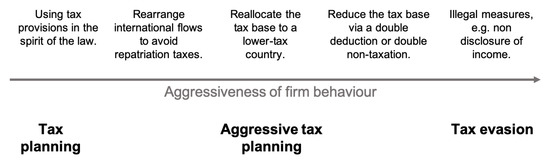

What Is Tax Planning vs. Tax avoidance is the use of loopholes in the taxation laws and conducting transactions so as to avoid tax liability or at least reduce the liability as far as possible. Tax Planning means reducing.

Tax avoidance and tax planning are both legal terms. Whereas tax planning assists corporations to achieve tax efficiency. The Govt is trying.

Difference between Tax Planning and Tax Evasion. Usually tax evasion involves hiding or misrepresenting income. For example Alex works at an.

In other words tax planning is an art in which ones financial affairs are logically planned in such a way that the assessee benefits from all of the taxation laws eligible. However amongst tax planning tax avoidance and tax evasion tax planning is arguably the best way to reduce your tax liability since it helps save taxes in a logical as well as. Tax evasion is considered a crime.

But tax evasion which is termed tax fraud is an unlawful. Tax avoidance is performed by availing loopholes in the law but complying with law provisions. As considered as fraud tax evasion is an illegal method to reduce tax.

There is a thin line of difference between the two but the consequences are far away from thin. Tax planning is using legal strategies to lower your tax. The penalties for tax evasion depend on the severity.

Tax evasion is undertaken by employing unfair means. Tax evasion is a federal crime that can result in substantial fines and even imprisonment. Answer 1 of 11.

Tax Planning Tax Avoidance And Tax Evasion What Is The Difference Financial Fundaz

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Cs Professional Programme Tax Notes Pdf Income Tax In India Dividend

Difference Between Of Tax Planning And Tax Management In Hindi Youtube

Tax Planning Meaning Strategies Objectives And Examples

Tax Planning Tax Avoidance Tax Evasion In Hindi Part 2 Youtube

Tax Planning Tax Evasion Tax Avoidance Youtube

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Corporate Tax Management Ppt Download

Aggressive Tax Planning And Corporate Tax Avoidance The Case Study Semantic Scholar

Ask The Expert What S The Difference Between Tax Planning Avoidance And Evasion Dmcl

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Planning Tax Avoidance Tax Evasion Tax Planning Management Taxation Laws Income Tax Youtube

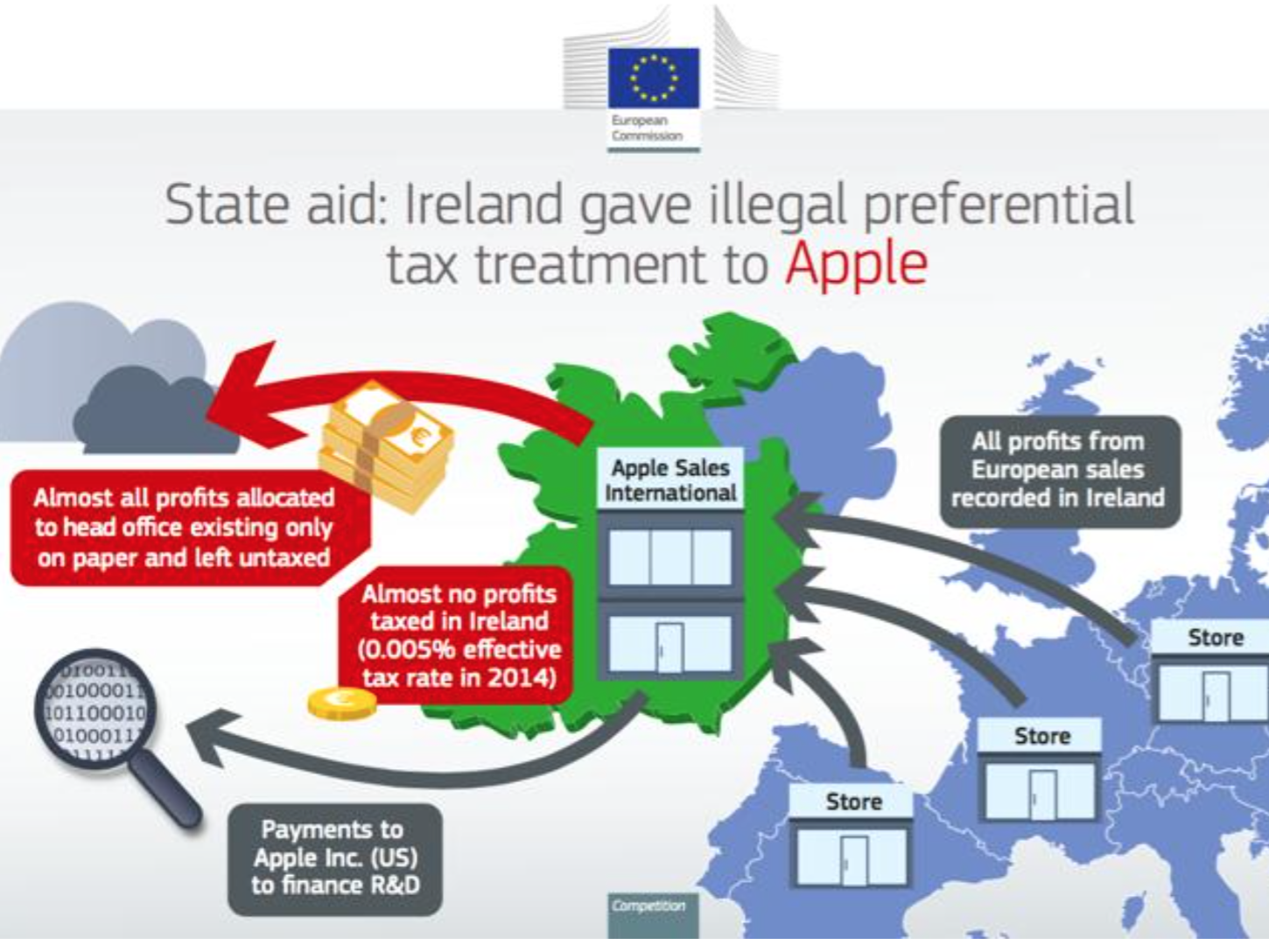

Apple S Tax Strategy Is Tax Avoidance And It Is Necessary Nasdaq Aapl Seeking Alpha

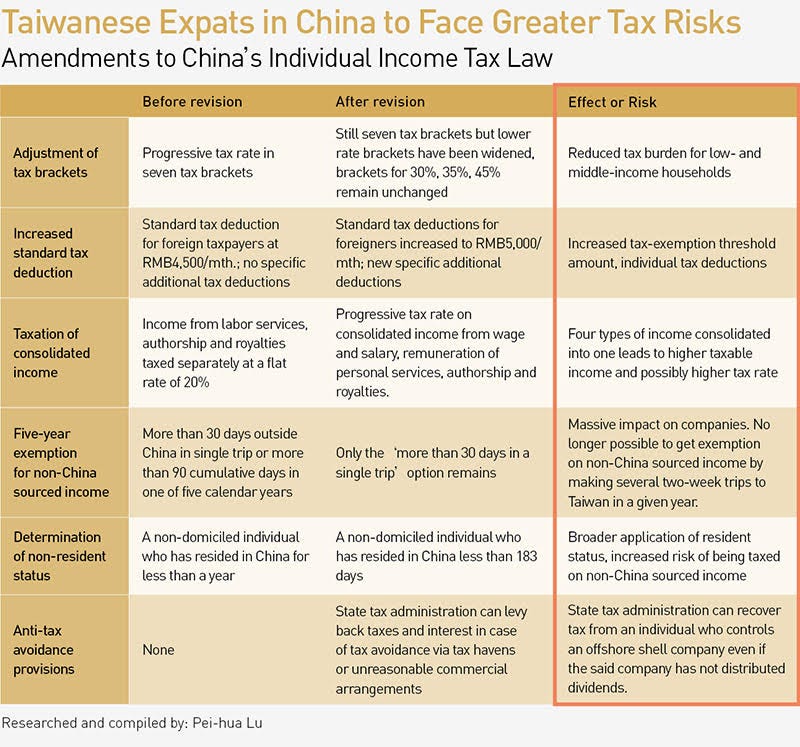

China Cracks Down On Tax Evasion Chasing Every Penny By Commonwealth Magazine Commonwealth X Crossing Medium

Tax Evasion What Is Tax Evasion Methods And Penalties

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion